Methods of Predicting the Unforeseen

Exploring the methodologies for predicting unforeseen economic and technological phenomena, combining data-driven models, interdisciplinary insights, and creative scenario

Introduction

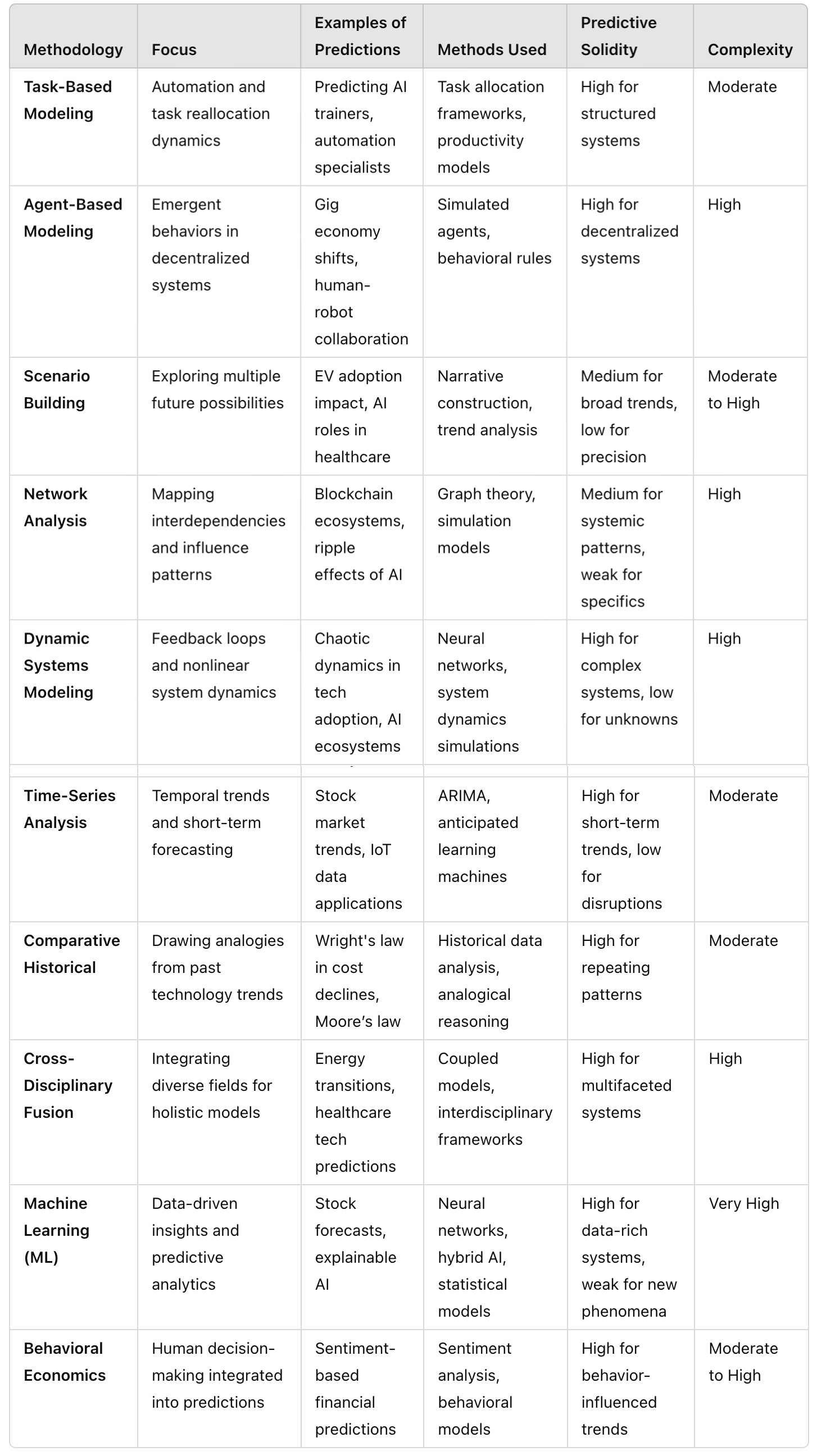

The ability to predict unforeseen developments in economic and technological systems has become increasingly critical in a world marked by rapid innovation and complex interdependencies. From forecasting entirely new job roles driven by automation to anticipating disruptive technological breakthroughs, the challenge lies in going beyond historical data to envision what has never occurred before. This process demands an integration of methodologies that balance theoretical frameworks, empirical observations, and computational modeling. Each method offers unique strengths in illuminating different facets of potential futures, from structured predictions in well-defined environments to exploratory scenarios in highly dynamic systems.

Achieving meaningful predictions in such uncharted territories involves employing diverse approaches tailored to the context and objectives of the inquiry. For structured systems, methods like task-based modeling and time-series analysis excel by leveraging established patterns and quantifiable relationships. These approaches are highly effective for forecasting outcomes in environments where historical regularities dominate, such as industrial automation or market trends. Conversely, methodologies like scenario building and dynamic systems modeling shine in capturing the complexity and uncertainty of systems characterized by non-linear interactions and feedback loops, offering insights into broader possibilities rather than deterministic outcomes.

Central to these predictive efforts is the interplay between human behavior, systemic dynamics, and technological evolution. Behavioral economic models, for instance, integrate human decision-making into forecasts, accounting for psychological and societal factors that influence adoption and change. At the same time, machine learning and artificial intelligence provide powerful tools for extracting patterns from vast datasets, enabling data-driven insights into emerging trends. By incorporating interdisciplinary perspectives, such as environmental science or sociology, cross-disciplinary fusion enriches predictions, allowing researchers to anticipate multifaceted phenomena like green energy transitions or healthcare innovations.

The methodologies highlighted underscore the need for adaptability and creativity in prediction science. No single method can fully encompass the breadth of possibilities in highly complex and fluid systems. Instead, combining approaches—leveraging the precision of data-driven models, the flexibility of scenario analysis, and the contextual insights of historical analogies—offers a path to understanding and preparing for the unforeseen. This blend of analytical rigor and imaginative exploration is essential for navigating the uncertainties of the future and transforming them into opportunities for growth and resilience.

1. Task-Based Modeling

Description

Task-based modeling evaluates the interaction between automation, human labor, and task reallocation in economic systems. It predicts how tasks are either automated, augmented by technology, or create new opportunities for human engagement.

Key Examples

"Predictive Modelling for Future Technology Development" by Preeti Bala (2021)

Focus: Discusses predictive analytics for understanding future technology trends using task-based frameworks.

Approach: Employs linear and nonlinear regression techniques to model the interaction of technological advancements with task creation and labor demand.

Method: Statistical tools like multivariate regression to analyze relationships between historical trends and emerging technology-induced roles.

Outcome: Predicts roles like AI trainers and augmentation specialists as automation evolves (Bala, 2021).

"Artificial Intelligence, Automation, and Work" by Acemoglu and Restrepo

Focus: Predicts future dynamics of job displacement and task creation caused by automation and AI.

Approach: Develops theoretical models linking automation to productivity gains and task reallocation.

Outcome: Highlights potential for new task creation in healthcare and education via AI-assisted solutions, such as individualized teaching models and advanced diagnostic tools.

Predictive Solidity

Strength: Strong for structured systems where task delineation is clear, such as factory automation or service industries.

Weakness: Predictions may falter in dynamic, rapidly changing industries where unforeseen innovations emerge.

Complexity

Moderate: Task-based modeling is relatively straightforward but requires robust data on existing roles and technologies.

2. Agent-Based Modeling (ABM)

Description

ABM simulates the actions and interactions of individual agents (e.g., workers, firms, consumers) to study the emergent behaviors of an economic system. This method is ideal for capturing decentralized decision-making processes in dynamic environments.

Key Examples

"A Bayesian Approach for Task Recognition and Future Human Activity Prediction" by Magnanimo et al. (2014)

Focus: Predicts how robots and humans collaborate in tasks using Bayesian networks.

Approach: Simulates task flows and interactions using real-time data from sensors.

Outcome: Demonstrates predictions of task completions and next steps in dynamic scenarios like industrial assembly or kitchen workflows.

Relevance: Highlights future scenarios in human-robot collaboration where tasks evolve in real-time (Magnanimo et al., 2014).

"Forecasting Future Action Sequences with Neural Memory Networks" by Gammulle et al. (2019)

Focus: Uses ABM with neural memory networks to predict future sequences of agent actions.

Approach: Simulates multi-agent interactions in environments like video analysis and robotics.

Outcome: Demonstrates how agents predict and adapt to dynamic environments, enabling real-time decision-making in autonomous systems (Gammulle et al., 2019).

Predictive Solidity

Strength: High for decentralized systems like gig economies, smart cities, and robotic collaborations where individual actions aggregate into system-wide changes.

Weakness: Limited when data on agent behaviors is sparse or when agents’ decision rules are oversimplified.

Complexity

High: ABM demands substantial computational resources and detailed data on individual agent behaviors.

3. Scenario Building

Description

Scenario building involves creating detailed narratives about potential futures by combining qualitative and quantitative insights. It helps in understanding uncertainties and planning for multiple possible outcomes, especially for disruptive technologies.

Key Examples

"Analysis of Technology Evolution Trends for Predicting Future Technologies" by Yong-Won Song (2020)

Focus: Examines technological evolution trends to predict future developments.

Approach: Uses 11 trends from historical data on technological evolution (e.g., increasing automation, modularity).

Outcome: Predicts future technologies objectively, such as modular AI systems and adaptive robotics.

Relevance: Highlights the structured, evolutionary patterns of technology, enabling the identification of disruptive innovations (Song, 2020).

"Combined Forecast Process: Combining Scenario Analysis with the Technological Substitution Model" by Ming-Yeu Wang & Wei Lan (2007)

Focus: Merges scenario analysis with technological substitution to predict the market trajectory of emerging technologies.

Approach: Combines qualitative narratives with quantitative models to analyze how new technologies replace older ones.

Outcome: Predicts future adoption rates and market dominance of technologies like fiber optics.

Relevance: Demonstrates how combining methods can provide richer insights into technology forecasting (Wang & Lan, 2007).

Predictive Solidity

Strength: Strong for exploring broad uncertainties and long-term outcomes; captures interdependencies between social, economic, and technological drivers.

Weakness: Qualitative aspects can introduce subjectivity, and scenarios often depend on the choice of initial assumptions.

Complexity

Moderate to High: Requires extensive data, stakeholder collaboration, and sophisticated modeling tools.

4. Network Analysis

Description

Network analysis maps and examines relationships between economic agents (e.g., firms, technologies, institutions). It identifies patterns of influence and growth, enabling predictions about technological diffusion and collaboration.

Key Examples

"Using Rare Event Modeling & Networking to Build Scenarios and Forecast the Future" by Chris Arney et al. (2013)

Focus: Combines network-based scenario development with rare-event modeling for predicting disruptive changes.

Approach: Uses networks to simulate state changes and calculate the impact of rare, high-impact events on technology adoption.

Outcome: Predicts how unexpected disruptions (e.g., sudden AI breakthroughs) reshape market structures and collaboration networks.

Relevance: Highlights how networks predict ripple effects of technological shifts (Arney et al., 2013).

"Scenario Prediction of Japanese Software Industry Through Hybrid Method" by Y. Kadono (2013)

Focus: Predicts future dynamics of Japan's software industry using network-based hybrid modeling.

Approach: Integrates social surveys, statistical analyses, and network-based simulations.

Outcome: Identifies key drivers like human capital and technological paradigms influencing industry growth.

Relevance: Demonstrates how network dynamics can predict industry-specific transformations (Kadono, 2013).

Predictive Solidity

Strength: Strong for identifying systemic patterns and interdependencies within technological ecosystems.

Weakness: Limited by the availability and accuracy of data on agent interactions.

Complexity

High: Requires advanced analytical tools and domain-specific expertise to map and interpret networks effectively.

5. Dynamic Systems Modeling

Description

Dynamic systems modeling uses mathematical and computational tools to predict the evolution of complex systems over time. It examines feedback loops, interdependencies, and nonlinear interactions within systems, making it particularly valuable for forecasting technological developments.

Key Examples

"Predictive Dynamical Systems" by T. Ohira (2006)

Focus: Proposes a framework where the dynamics of a system are influenced by its own predictions of future states.

Approach: Uses mathematical formalism to model the feedback mechanisms between current and predicted future states.

Outcome: Demonstrates how predictive systems can lead to stabilization or oscillation, depending on the predictive horizon.

Relevance: Useful in designing adaptive AI systems that learn from future-state predictions (Ohira, 2006).

"Neural Machine-Based Forecasting of Chaotic Dynamics" by Wang et al. (2019)

Focus: Applies neural networks to predict chaotic systems, such as weather or stock markets.

Approach: Combines deep recurrent neural networks with chaotic systems simulations to enhance prediction accuracy.

Outcome: Successfully predicts short-term dynamics in chaotic systems and identifies key factors contributing to long-term unpredictability.

Relevance: Demonstrates how machine learning can complement dynamic systems modeling for technology and market forecasts (Wang et al., 2019).

Predictive Solidity

Strength: High for systems where data is abundant and interactions are well-understood, such as supply chain dynamics or ecosystem modeling.

Weakness: Limited for systems with extreme uncertainties or where key variables are unmeasurable.

Complexity

High: Requires sophisticated modeling tools and significant computational power to simulate complex feedback loops and nonlinearities.

6. Time-Series Analysis

Description

Time-series analysis examines patterns in historical data to predict future trends. It is widely used in economics, finance, and technology to model temporal dependencies and extract actionable insights.

Key Examples

"Predicting Future Dynamics from Short-Term Time Series Using an Anticipated Learning Machine" by Chuan Chen et al. (2020)

Focus: Predicts future system states using short-term, high-dimensional time-series data.

Approach: Develops an anticipated learning machine (ALM) that transforms spatial correlations into temporal predictions.

Outcome: Achieves multistep-ahead predictions, outperforming traditional models on real-world datasets.

Relevance: Particularly effective in technology-driven sectors like IoT and smart city planning (Chen et al., 2020).

"Dynamic Modeling of Present and Future Service Demand" by Lyons et al. (1997)

Focus: Explores how societal trends and market dynamics influence service demand.

Approach: Combines traditional time-series analysis with dynamic system modeling to predict service trends.

Outcome: Identifies the key drivers of service growth and provides actionable insights for market strategies.

Relevance: Demonstrates how time-series analysis can be adapted to rapidly evolving industries (Lyons et al., 1997).

Predictive Solidity

Strength: Reliable for short-term predictions where historical trends dominate, such as in financial markets or consumer demand forecasting.

Weakness: Struggles with abrupt changes or disruptions not reflected in historical data.

Complexity

Moderate: Requires expertise in statistical methods and access to quality historical data but is less resource-intensive than dynamic systems modeling.

7. Comparative Historical Analysis

Description

Comparative historical analysis examines past technological changes to identify patterns and use them to predict future trajectories. It compares technologies across time and contexts to draw parallels and project outcomes.

Key Examples

"Statistical Basis for Predicting Technological Progress" by Nagy et al. (2012)

Focus: Evaluates Wright's law and Moore's law as predictors of technological progress using historical data from 62 technologies.

Approach: Compares past trends in cost reductions and production increases to forecast future technological advancements.

Outcome: Demonstrates that Wright's and Moore's laws predict cost reductions and production efficiency with high accuracy across diverse industries.

Relevance: Highlights how historical regularities can reliably predict future technology trends (Nagy et al., 2012).

"Towards a More Historical Approach to Technological Change" by Gavin Wright (1997)

Focus: Analyzes the historical trajectory of American technological leadership and its implications for global technological advancements.

Approach: Uses historical and comparative data to examine path dependence and the role of institutional structures in shaping technological progress.

Outcome: Suggests that historical analysis provides a nuanced understanding of how specific industries adapt to technological innovation.

Relevance: Useful for policy development and investment strategies based on historical analogies (Wright, 1997).

Predictive Solidity

Strength: High when technologies evolve linearly or exhibit repeating patterns (e.g., cost declines following Wright's law).

Weakness: Limited for disruptive technologies that diverge from historical patterns or introduce unprecedented paradigms.

Complexity

Moderate: Requires detailed historical data and expertise in drawing parallels between past and present technologies.

8. Cross-Disciplinary Fusion

Description

Cross-disciplinary fusion integrates insights from multiple fields (e.g., economics, sociology, and technology) to build comprehensive models for predicting technological evolution.

Key Examples

"Forecasting Technological Discontinuities in the ICT Industry" by Hoisl et al. (2015)

Focus: Explores signals of technological discontinuities, such as shifts in user needs or legal frameworks, in the ICT sector.

Approach: Combines evolutionary innovation theories with empirical data from experts in the ICT industry.

Outcome: Identifies indicators for predicting technological disruptions and distinguishes between internal and external expert perspectives.

Relevance: Demonstrates the value of integrating economic, legal, and technological insights for disruption forecasting (Hoisl et al., 2015).

"Modeling Technological Change: Implications for the Global Environment" by Grubler et al. (1999)

Focus: Investigates the impact of technological change on environmental and economic outcomes.

Approach: Uses coupled economic and technological models to analyze energy sector innovations and their environmental implications.

Outcome: Predicts the long-term adoption patterns of energy-efficient technologies and their impact on global carbon emissions.

Relevance: Highlights the role of interdisciplinary approaches in understanding and managing technological transitions (Grubler et al., 1999).

Predictive Solidity

Strength: High for systems influenced by multiple interacting factors, such as energy transitions or ICT advancements.

Weakness: Predictions may become less precise when disciplines conflict or when assumptions from one field dominate.

Complexity

High: Requires collaboration between diverse fields and reconciliation of differing methodologies.

9. Machine Learning and AI Models

Description

Machine learning (ML) and artificial intelligence (AI) leverage historical and real-time data to predict future trends, outcomes, and events. These models excel in identifying patterns in large datasets and applying them to complex, dynamic systems.

Key Examples

"Exploring the Future of Stock Market Prediction through Machine Learning" by Jain et al. (2024)

Focus: Analyzes how ML models predict stock market trends using techniques like artificial neural networks (ANNs) and hybrid AI methods.

Approach: Groups different ML methods (e.g., regression, ANNs, genetic algorithms) and examines their predictive power in various scenarios.

Outcome: Highlights ML's ability to improve prediction accuracy and suggests combining multiple models for optimal results.

Relevance: Demonstrates how ML is revolutionizing financial predictions and highlights areas for future research (Jain et al., 2024).

"Current Advances, Trends, and Challenges of Machine Learning and Knowledge Extraction" by Holzinger et al. (2018)

Focus: Discusses the integration of explainable AI with ML for enhanced predictive models in multiple domains.

Approach: Advocates combining statistical and logical methods to build context-adaptive systems similar to human cognition.

Outcome: Envisions AI systems capable of high interpretability and adaptability for future technological applications.

Relevance: Highlights the importance of explainable AI in ensuring trust and effectiveness in predictions (Holzinger et al., 2018).

Predictive Solidity

Strength: High for structured datasets with known variables; effective in dynamic, data-rich environments like stock markets or healthcare.

Weakness: Limited by data quality, interpretability, and inability to predict unprecedented events.

Complexity

Very High: Requires advanced computational infrastructure, expertise in algorithm design, and continuous model optimization.

10. Behavioral Economic Models

Description

Behavioral economic models incorporate human behavior and decision-making into traditional predictive frameworks. These models are particularly effective in understanding how psychological and social factors influence economic trends.

Key Examples

"The Impact of AI and Machine Learning on Stock Market Predictions" by Talreja and Thavi (2024)

Focus: Explores how AI models integrate sentiment analysis and behavioral factors into stock market forecasting.

Approach: Combines historical data and sentiment analysis from news and social media to predict market movements.

Outcome: Demonstrates that incorporating human factors improves the accuracy of financial predictions.

Relevance: Highlights the interplay between technology and behavioral dynamics in shaping economic outcomes (Talreja & Thavi, 2024).

"Examining the Potential of Artificial Intelligence and Machine Learning in Predicting Trends" by Asere and Nuga (2024)

Focus: Explores the role of behavioral insights in ML-driven predictions for investment decision-making.

Approach: Uses AI to analyze trends in investor behavior and optimize portfolio management.

Outcome: Improves investment strategies by integrating psychological and technological insights.

Relevance: Demonstrates how AI leverages behavioral data to refine economic predictions (Asere & Nuga, 2024).

Predictive Solidity

Strength: High for domains where human behavior significantly influences outcomes, such as financial markets or consumer behavior.

Weakness: Less effective in highly automated or non-human-driven systems.

Complexity

Moderate to High: Requires integration of psychological, sociological, and economic variables, alongside computational modeling.